YFII is a DeFi protocol that facilitates yield aggregation and uses a token halving model to ensure equitable distribution of tokens. It is a fork of YFI.

Decentralized lending is the driving force behind decentralized finance (DeFi) projects. Those who provide liquidity to these projects earn interest through yield farming or liquidity mining.

Some DeFi networks have their own token that increases rewards to yield farmers. Others like YFII have been forked from other protocols to prevent a reduction in pool liquidity through a scheduled halving model.

In the Chinese market, YFII has earned the DeFi community’s trust shortly after forking from YFI. Among the reasons given for the hard fork include preventing wealthy participants from spoiling the party. So, what is YFI?

Table of Contents

Background

To have a clear background of how and why YFII was born, let’s start from the top; Yearn. Yearn is not necessary a DeFi protocol like Compound or Aave.

Instead, it aggregates deposits and delivers them to a network that would give depositors the highest interest. The platform uses yToken to facilitate the withdrawal of earnings and deposits. However, governance on Yearn is enabled using the YFI token.

But, as the token was issued to yield farmers for pools’ liquidity provision, it presented a looming drop in pool liquidity because of a weekly supply increase of 30,000 YFI. To prevent inflation, a YIP (yEarn Improvement Proposal)-8 was issued. In the proposal, the system would initiate a weekly halving of issued YFI tokens to provide for a steady change in liquidity.

When votes were cast, 80 percent were for the proposal, while 19 percent were against. Unfortunately, the needed 33 percent quorum was not achieved. YFII was born through a hard fork and implemented the YIP-8 proposal.

In the first week, 30,000 tokens were removed from total circulation. YFII is led by an anonymous team that goes by the pseudonym “White Noise”, providing updates on Medium. The YFI clone holds that its halving model mirrors that of Bitcoin (BTC) “so that the tokens will be fairly distributed to the community.”

What is YFII?

YFII is a DeFi protocol that facilitates yield aggregation and uses a token halving model to ensure equitable distribution of tokens. The protocol is currently popular in the Chinese DeFi market.

The contrast is that YFI was developed in the west, while YFII is the eastern region. Surprisingly, the clone started on a high note in its new market compared to its parent performance in the west.

Elaborately, after being launched towards the end of June 2020, a few Chinese liquidity miners joined the new force. However, a few days later, the network attracted cryptocurrency exchanges, virtual currency hedge funds, mining pools, and centralized finance projects.

The protocol has a strong community that gathers on WeChat. This indicates the diplomatic standoffs between China and the United States since discussions on the social media platform effectively blocks English-speaking persons from the US.

The project’s pink-colored poster portrays its inclination to the young generation that’s nationalistic. “We are pissed at Balancer’s hostile blacklist,” the sign reads.

Liquidity providers on YFII are newcomers in the DeFi world. Unfortunately, the road ahead looks bumpy for YFII. For instance, the network blocked all methods for updating or modification. This makes it hard for the system’s token economics to be upgraded.

Experts warn that the platform’s community has to look for ways to make it decentralized to attract a vibrant ecosystem. But, as it is, the community may be after profits from yield farming.

Governance issues on the network are delegated to 11 signatories that engage using a multi-signature model. Seven of the 11 signatories have to agree to reach consensus.

However, this is a temporary governance model as the project implements governance through a decentralized autonomous organization (DAO). Just with DeFi protocols such as SushiSwap, YFII’s smart contract is unaudited.

Trading the project’s token can be done on Balancer and Binance. Balancer enables a swap between YFII and DAI while Binance facilitates the trading of YFII for BTC, Binance Coin (BNB), Binance stable coin (BUSD), and USDT.

How to do Yield Farming in YFII

Currently, YFII has one of the highest ROI that can go up to 2000 percent in some pools. Despite the high returns on investment, liquidity mining carries its share of risks, such as the volatility of the token price and unseen errors on the smart contract.

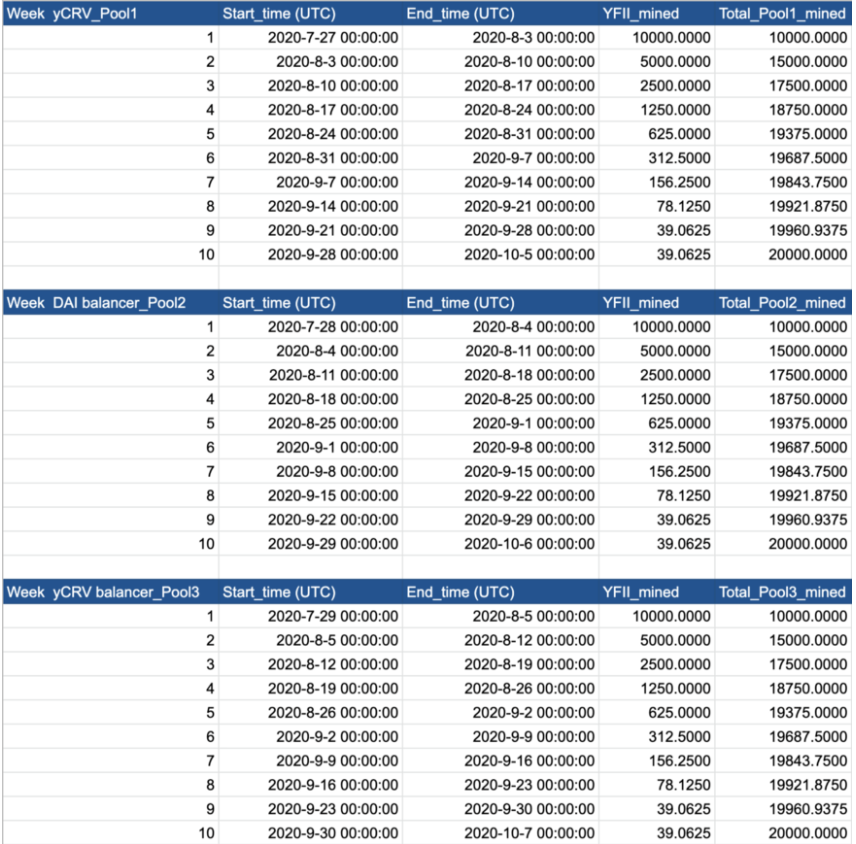

The procedure for farming yields on YFII depends on the token that a yield farmer is willing to stake. This is further divided into three pools.

Pool 1 (yCRV)

This pool is for those holding yCurve tokens. To farm on YFII, a trader needs to exit from pool three on YFI to get yCRV tokens. Those without the tokens can visit www.curve.fi/iearn and deposit either USDT, USD Coin (USDC), True USD (TUSD), or DAI to generate the yCRV tokens.

Next, stake the tokens on the Yearn pool. Staked funds are automatically invested in different DeFi projects. While this has the potential of increased returns, it also carries high chances of a loss if these systems’ security is breached.

Pool 2 (DAI Balancer)

This pool uses DAI or YFII tokens to allow yield farming. Staking is done on the Balancer Liquidity pool, where it generates BPT tokens that are staked in the Balancer (YFII-DAI) pool. Note that adding liquidity on Pool 2 was directly halted to mitigate the risk of infinite minting.

Funds staked in this pool are directed towards market-making automation. Therefore, an unpredicted massive liquidation of YFII tokens can negatively affect the token’s price resulting in fewer pooled assets.

Pool 3 (yCRV Balancer)

Here, a yield farmer needs to stake YFII tokens in the “governance” pool to get rewards.

Pool 4 has also been suggested but not currently active. The pool will facilitate earning interest on evolving DeFi assets by either staking YFII or its derivatives.

Conclusion

The DeFi scene is rapidly changing to include players like SushiSwap and yield aggregators like YFII. Unfortunately, the growing list of unaudited smart contracts in this scene is curtailing open-intake from conservative circles.

Also, with yield farmers running for quick returns, the current liquidity mining frenzy resembles, from a distance, the initial coin offering (ICO) craze of 2017. As DeFi protocol and their forks take shape, time will tell who played the game and who was played.