As if things couldn’t get any crazier in the DeFi world, yEarn.Finance has risen to the ranks as the hottest new DeFi player. yEarn is a yield aggregator for lending platforms like Aave, Compound, Dydx, and Fulcrum.

What drew a lot of attention from the project is the potential to earn overly high returns. It allows people to use multiple DeFi platforms simultaneously to generate the highest yield possible.

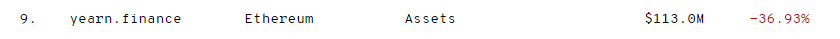

Many investors see this as one of the largest sources of passive income. And many have already jumped on board. It currently has over $113 million assets locked up.

In July 26, it hit its all-time high at roughly $345 million TVL.

Table of Contents

Background

Previously known as iEarn, yEarn is the brainchild of developer Andre Cronje.

Cronje had recognized that yield farming had become way too complex and anticipated that complexity to worsen over time. As more people wanted to combine multiple lending platforms to stack up more earnings, it became harder and harder to assess if they were actually making profits.

In response to this, Cronje knew that he needed to provide a new product that would simplify the process and allow anyone to seed these yield farming schemes instead of manually choosing between them.

What is yEarn Finance?

yEarn functions as a decentralized aggregator of yield farming opportunities. It allows users to optimize their yield farming results by combining different platforms.

When a user deposits tokens to the platform, their tokens are converted to yTokens. yTokens are regularly rebalanced to choose the most profitable DeFi services.

Curve happens to be the leading integrator of yTokens as it has created an Automated Market Maker (AMM) between yUSDT, yUSDC, yTUSD, yDAI. In fact, users are able to earn lending fees and trading fees on Curve simultaneously.

yEarn Products

yearn.finance

This allows profit-switching between different DeFI platforms like Aave, Compound, Curve, etc. autonomously.

ytrade.finance

yTrade allows you to leverage trade up to 1000x with initiation fee and 250x without. Supported currencies tokens include $DAI, $USDC, $USDT, $TUSD, and $sUSD. This system is still in beta phase so use at your own risk.

yliquidate.finance

This is an automated liquidation mechanism for Aave. yLiquidate allows 0 capital liquidations on a first-come-first-serve basis.

yleverage.finance

This enables the creation of a 5x leveraged Dai vaults with USDC.

yswap.exchange

The yswap exchange offers a stable AMM, which allows single sided liquidity provision.

YFI token

YFI is the governance token of the yEarn ecosystem. It is distributed to users who provide liquidity to any of its platforms with yTokens. It is considered one of the most decentralized token evern issued since it has no pre-mine, pre-sale, or even allocation to the founder.

It was created as a way to surrender the governance of the yEarn system to the community.

In further efforts to give up this control (mostly because we are lazy and don’t want to do it), we have released YFI, a completely valueless 0 supply token. We re-iterate, it has 0 financial value. There is no pre-mine, there is no sale, no you cannot buy it, no, it won’t be on uniswap, no, there won’t be an auction. We don’t have any of it.

Andre Cronje

But as it turns out, the community apparently disagrees with Cronje, seeing that the token has risen from 0 to over $3,000. Furthermore, it can now be traded on Poloniex, MXC, CoinEx, Uniswap, and other marketplaces.

You can earn YFI by providing liquidity to any of the yEarn products.

How to stake yTokens

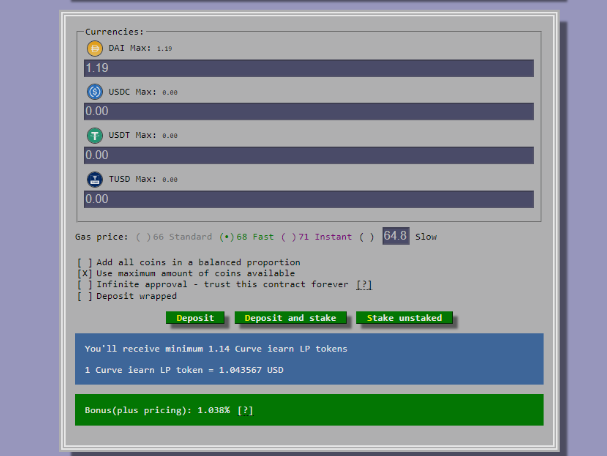

Before you can stake yTokens be sure to provide liquidity to Curve’s YPool by going to this page and connecting your web3 wallet.

Once done, you will be able to get yTokens. Then, a new “Stake unstaked” button will appear.

Click it and confirm to spend your yTokens. Now you can start earning YFI. Your share should be reflected on your profile page.

Conclusion

yEarn brings DeFi to a whole new level with its innovative functionality. It is not meant to compete with existing DeFi protocols, but rather, to work with them.

The objective of yEarn.finance is to help yield farmers make the most of their tokens. It doesn’t limit users to one platform but enables to work with multiple DeFi platform at the same time.

Furthermore, it is also one of the most decentralized projects ever conceived in the space considering that the founder basically handed control over to the community.

References: https://boxmining.com/yfi-yield-farming/