Stellar (XLM) is a payment-focused digital currency that runs on the Stellar network, a decentralized open blockchain.

One might say that if Bitcoin and XRP were to get married, Stellar would be the child. It possesses the great qualities of these two strikingly different cryptocurrencies.

It is permissionless and decentralized, like Bitcoin. At the same time, moving value within the platform is fast, cheap, and energy-efficient, just like in XRP.

The aim of the Stellar project is to be able to move all forms of money, whether that be dollar, yuan, or bitcoin, like email. Essentially, they want to unite all financial systems under one single platform — the Stellar network.

The project is managed both by the Stellar Development Foundation, a non-profit organization, and its community. It is completely owned by the public, which means that there are no leaders, not even the founding members.

Table of Contents

Background

The Stellar Development Foundation was founded in 2014 by serial entrepreneur and programmer Jed McCaleb, and former lawyer Joyce Kim. That same month, the Stellar protocol was also released.

McCaleb is one of the most acclaimed individuals in the crypto space and is considered a genius by his peers. He had founded several companies that developed decentralized systems such as eDonkey, Overnet, and the scandalous Mt Gox—one of the first bitcoin exchanges in the world.

Furthermore, he was also the co-founder and former CTO of Ripple Labs, which brought about XRP — currently the top third digital currency in market cap and number one rival of Stellar Lumens (XLM).

Stellar has secured partnerships with several major players in finance and tech including IBM, Stripe, HTC, Deloitte, Wanxiang Group, and many more.

Six banks are currently working on the issuance of their own stablecoins on an IBM payment system, using the Stellar blockchain. Among them are RCBC (Philippines), Banco Bradesco (Brazil), and Bank Busan (South Korea).

Stellar Network

The Stellar network is a decentralized blockchain that enables fast and low-cost payment transactions worldwide.

It connects individuals, banks and other institutions, and payment processors in order to revolutionize payments and remittances, making them faster, safer, and cheaper than the current banking landscape.

The Stellar network consists of several interconnected components:

- Stellar Consensus Protocol

- Stellar Core

- Anchors

Stellar Consensus Protocol

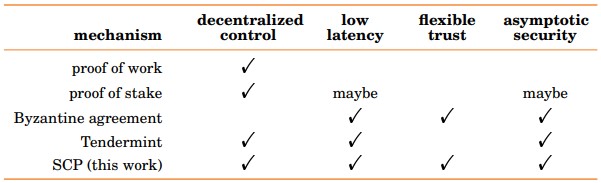

The Stellar Consensus Protocol (SCP) is an algorithm that ensures that a decentralized system remains homogeneous (have similar protocols and configurations) and tamper-free. It does this by keeping the majority of the network participants in agreement with the state of the network.

The major goal of the SCP is to prevent bad actors from double-spending — a form of fraud where new XLM or other coins are created out of thin air, which is detrimental to the economy of the Stellar network.

Furthermore, it has a set of safety precautions in place. In the event of a network attack or coordination of malicious network participants, the network will interrupt its operations until a consensus is reached.

The SCP is originally a fork of the Ripple Protocol but has gone through several code changes that it might as well be its own thing.

The protocol uses an accounting database shared across several thousands of user-owned computers to store account balances and transaction data.

No one is above the consensus protocol; not even the founders. In addition, anyone can participate in collective decision-making procedures. Since network participants vote for their desired outcomes until a consensus is reached, nothing undesirable will happen to the network. Not even if some nodes fail or malicious ones interfere.

Stellar Core

We kept mentioning nodes in the previous section. Nodes are simply what we call the devices that run Stellar software. And by software, we mean Stellar Core.

Stellar Core is an implementation of the SCP. To illustrate this better, we’re going to use Bitcoin as an example.

The Bitcoin protocol (same as the Stellar Consensus Protocol) has three major implementations: Bitcoin Core (BTC), Bitcoin ABC (BCH), and Bitcoin SV (BSV). And the SCP has Stellar Core.

In order to participate in the consensus process, you’ll need to download the Stellar Core software. Unlike in Bitcoin and Ethereum, there is no monetary reward in participating in the consensus procedures. However, you do get other perks such as customization of APIs, full view of the Stellar blockchain, etc.

Looking at the Stellar validators list, we could see that most of the nodes are from IBM, FairX, SatoshiPay, Hawking Network, StellarPort, etc. These are businesses that have a stake in Stellar’s success.

Anchors

Anchors are the bridge between the Stellar network and traditional institutions and payment systems. It allows all the world’s currencies to merge under one seamless platform.

The current financial framework is fragmented. There are several payment processing standards such as SEPA, ACH, and SPEI, which aren’t interoperable. This forces companies to continue using outdated platforms like SWIFT and the current banking model.

Stellar wants to unite all these diverse payment systems under one decentralized ledger — the Stellar blockchain. Not only will this allow all fiat currencies and cryptocurrencies to interoperate, but also all their digital wallets and applications.

The anchors are tasked to facilitate the movement of money from the traditional banking systems to Stellar and vice-versa. These anchors may be fintech companies, money transfer service providers, or regulated financial institutions.

In order to become an anchor, an entity must offer one or both of the following services:

- Fiat token issuance — issue one-to-one fiat-backed stablecoins while maintaining reserves equal to the total value of all issued tokens. This will allow users to redeem the tokens back to fiat at any given time.

- Fiat on-ramp and off-ramp services — allows users to make smooth deposits and withdrawals. This includes the management of all the necessary regulatory processes to make sure their service is compliant with their nation’s laws.

Stellar Token Launchpad

Ethereum may be the most popular ICO platform, but that doesn’t mean that Stellar is any less worthy of hosting new tokens offerings.

After all, the Stellar blockchain also provides instant liquidity to newly-launched tokens through their built-in exchange, the Stellar DEX. You can access several DEX UIs such as StellarX, Stellarport, Stellarterm, etc.

New token companies will be able to list their tokens on the first day, instead of waiting for months hoping to be listed by a popular exchange like Binance.

This affords digital currency projects to be less dependent on IEO platforms, since these companies take a huge share of their tokens, on top of the pricey listing fee they charge.

Not to mention the Stellar network only has 1-3 seconds confirmation time, which makes it a lot faster than Ethereum’s 6 minutes. Its transaction fees are also much cheaper. This provides a low barrier to entry for coin companies and developers to build on the network.

Tokens Launched on the Stellar Network

- Smartlands (SLT)

- SureRemit (RMT)

- Cowrie (NGT)

Stellar Lumens (XLM)

Lumens, denoted by ticker symbol XLM, is the native asset of the Stellar blockchain. This cryptocurrency serves two main purposes:

- Spam Attack Prevention

- Mediator for Multi-currency Transactions

Spam Attack Prevention

With a capacity of 1,000 transactions per second, transferring value within the Stellar network is quick and easy. But if sending payments was completely free, the Stellar blockchain could become filled with spam or malicious transactions that could overload the system.

The Stellar Development Foundation has therefore implemented a small friction to ward off bad actors while still keeping the system low-cost and widely accessible. Each account is required to have a minimum balance of 1 lumen. In addition, sending transactions would induce a small fee of 0.00001 lumens.

Mediator for Multi-currency Transactions

The XLM digital currency facilitates multi-currency transactions by acting as a bridge layer between various currencies. Let’s illustrate how this works.

Suppose Charlie, in India, wants to send 6,000 Rupees to Jules, in the US. He wants her to receive the money in USD.

User’s Perspective

Charlie inputs 6,000 INR in his wallet app. He types Jule’s payment address, indicates that she should receive the money in USD, and taps send. Five seconds later, she has 84.16 USD in her wallet app. The transaction costs only $0.000001.

App Perspective

Once Charlie demonstrates his wish to send 6000 INR as USD to Jules, his wallet app looks to Stellar’s built-in exchange, to the order books for Indian Rupees. The Stellar system searches for the best offer, or sequence of offers, for turning Charlie’s INR into USD. Then, the conversion happens directly or indirectly.

The Stellar system will always find the best prices efficiently.

Exchanges to Trade XLM

- Binance

- MXC

- LATOKEN

- Coinbase Pro

- Huobi

The Future of Stellar Network

Stellar is definitely one of the most remarkable crypto projects to date. It is decentralized, has a permissionless blockchain, has a competent team, and is built around an altruistic philosophy. Furthermore, the Stellar organization also has big-time players to help secure its future in the space.

However, the project will still face several challenges moving forward. For one, they have strong competition. Ripple’s XRP is nearly eight times the value of XLM in market cap.

All things considered, this is a very interesting project.

Image courtesy of Farber-Alen/Bigstockphoto