Raydium is an automated market maker that runs on the Solana blockchain and allows for fast transactions, shared liquidity and ultra-low fees.

The DeFi space has really enjoyed tremendous growth due to its several use case and has come up with amazing projects which have served as alternative platforms for financial services. DeFi-based products have an advantage over legacy methods since they are decentralized, trustless, and fast. Lately, the DeFi space is gaining more traction due to the growth of platforms like Binance Smart Chain (BSC).

Before the development of automated market makers (AMMs), DeFi projects have suffered greatly from liquidity problems. There were very few buyers and sellers to carry out transactions on these platforms regularly. However, AMMs has been able to solve this problem by providing liquidity pools and incentivizing liquidity providers to supply assets to these pools.

Table of Contents

What is Raydium?

Raydium is an automated market maker that runs on the Solana blockchain and allows for fast transactions, shared liquidity, and ultra-low fees. The protocol leverages the order flow of Serum to allow users to access the best prices for assets. It also utilizes the intrinsic features of Solana to move liquidity from its pools to other parts of the network.

Furthermore, users who supply money to the pools earn the fees from trades that occur on the network. The pools on the network will reward LPs for their contribution to the pools. Novel projects can leverage Raydium’s features to benefit from its liquidity.

An AMM is a financial tool in the DeFi space that depends on a pricing algorithm to quote assets prices. This means that unlike the traditional order book, AMMs determine the price of an asset using complex mathematical formulas. Also, they are decentralized, permissionless, and non-custodial; that is, they require no interference from any third party.

Advantages of Raydium

Different from other AMMs, Raydium protocol has access to Serum’s order book which helps with liquidity. Also, the Ethereum blockchain currently has scalability challenges and is becoming more expensive for users to carry out transactions. Raydium offers users some advantages that differentiate it from other platforms, such as:

Fast transactions and low fees

The protocol handles scalability better than other DeFi platforms because it extends the intrinsic properties of the Solana blockchain. One major problem of DeFi is that the transactions are very costly and slow, which drives away potential transactors. However, with Raydium, transactions occur at a relatively low cost due to the powerful features of the blockchain.

Access to Serum’s decentralized exchange order book

AMMs on other DeFi platforms provide little related to liquidity because of the way they have been constructed. There is no connection between the liquidity pools available on the different protocols – liquidity is difficult to move between protocols. However, unlike other automated market makers, Raydium provides access to liquidity on the whole protocol.

Interactive Platform

Traditional trading features are very difficult to be executed on DeFi protocols due to the lag time between transactions. However, Raydium gives users the option to view trade charts, set limit orders, and have full access to their funds. In summation, traders can track and monitor their trades individually, and thus, eliminate the need for a middleman.

Scalability

Raydium is a key part of Serum that makes it possible to bring new projects into the network. In essence, it makes it possible to integrate other DeFi projects into the Solana and Serum protocols. Developers can launch their Projects through Raydium to enjoy the powerful features that the blockchain provides and access immense liquidity.

Improved trading experience

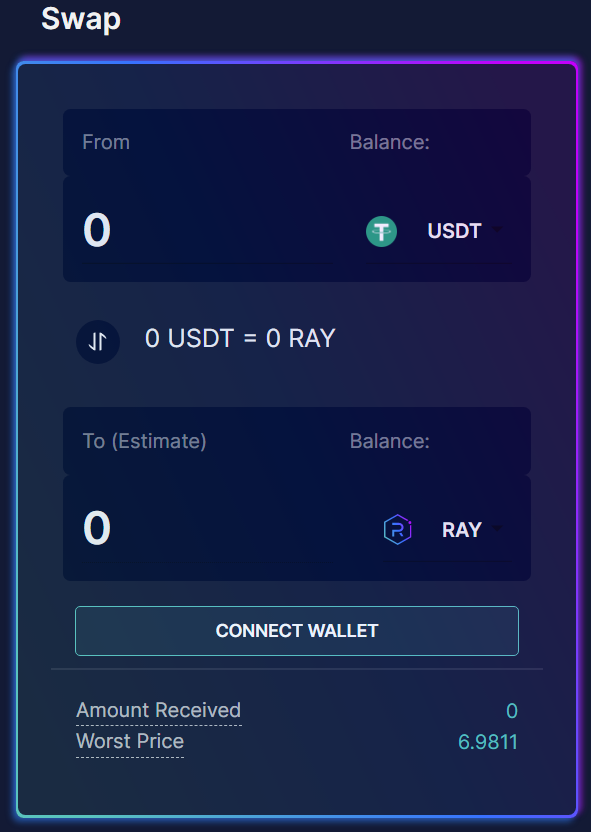

Users can exchange two tokens at great speeds using Raydium’s swap feature. The Serum DEX makes it possible for users to access more intricate tools such as limit orders.

Raydium Token (RAY)

RAY tokens are ERC-20 compliant and the current circulating supply is 11,273,830 while the maximum supply is 555,000,000. 34% of all the available tokens are allocated to the mining reserve. A percentage (0,03%) of transaction fees are awarded to users who stake their RAY tokens.

One other way through which users can earn RAY tokens is by depositing their funds to farming pools. Users that make transactions on the platform pay a fee, which is then redistributed to LPs and stakers.

How does the Raydium Liquidity Pool Work?

Liquidity pools are like a big dump of funds that traders can trade against and are usually provided by liquidity providers. In a word, liquidity providers deposit funds to the liquidity pools and are rewarded for doing that. Raydium allows anyone to become a liquidity provider (LP) by depositing money to the liquidity pools.

As a result of their contribution to the pools, liquidity providers are given tokens. For instance, users who deposit $RAY and $USDC to the pools are given a token that is specific to the pair. This represents a portion of the pooled assets, which the liquidity provider can use to claim their reward.

Each time a RAY-USDC trade occurs, transactors will pay a 0.25% fee, which is redistributed to the liquidity providers and stakers. Liquidity providers get the larger portion of the fee (0.22%), while the rest goes to users who stake their RAY tokens.

What are Raydium’s plans?

Raydium plans to collaborate with other AMM and DeFi projects to allow for the expansion of the Serum network. Combining the best features of Serum and Solana will allow Raydium to supply liquidity to new borrowing and lending platforms. This also makes it possible for those projects to benefit from the speed and efficacy of both protocols.

The lower transaction fees, higher liquidity and speed will attract more people and projects to the network. It will help to supply more liquidity to the networks through its access to the central order book and by incentivizing LPs. It will also leverage the best features of Solana to drive innovation in the ecosystem and the progress of the DeFi.

Conclusion

Raydium is one of the leading AMMs in the DeFI space that allows users to trade with most of the features available to CeFi. As a result, this will drive the evolution of the DeFi space by acting as a bridge between CeFi users and the crypto world. Although a lot of DEXs are trying to achieve this goal, Raydium is another interesting addition as it offers more features without sacrificing security and decentralization.