Flow Protocol powers FLOW, an Ethereum based self-distributing token that looks to evenly spread inflations to all its holders.

Decentralized Finance (DeFi) is growing at a breakneck speed. We have seen the industry move from having $1 billion in its total value locked as of January 2020 to over $20 billion this year. While different assets have sprung up to different use cases, demand for collateralized DeFi tokens to fill specific roles has also risen.

Through its FLOW token, the Flow Protocol has taken up the gauntlet and looks to help diversify how collateral can be used to benefit the space. Here, we discuss how the Flow Protocol operates extensively.

Table of Contents

What is Flow Protocol?

Flow Protocol powers FLOW, an Ethereum based self-distributing token that looks to evenly spread inflations to all its holders. The token does this by applying the single-responsibility principle (SRP) from software engineering.

Basically, all addresses holding this token would be able to receive the distributed inflation regardless of the fact that they perform a transaction or not. Inflation happens to the asset daily, and holders and non-holders of the coin do not need to perform any action. This way, the applied inflation method can be used in different DeFi use cases without impacting the token holders, i.e., the value of their crypto coins remains undiluted.

After ten years, the inflation rate becomes significantly reduced, and a capped supply of the FLOW tokens becomes eminent.

In this sense, Flow fulfills a specific role in the DeFi space as it can be used alongside other virtual digital assets that carry out other duties. This means that FLOW and ETH or any other cryptocurrency can be combined, And, they would expectedly carry out their desired function with FLOW acting as collateral for these tokens.

It is not overly necessary to stake or lock FLOW into a contract before it receives its share of the inflation; this allows it to achieve its distribution target and its usage in a wide range of DeFi applications.

Flow Token (FLOW)

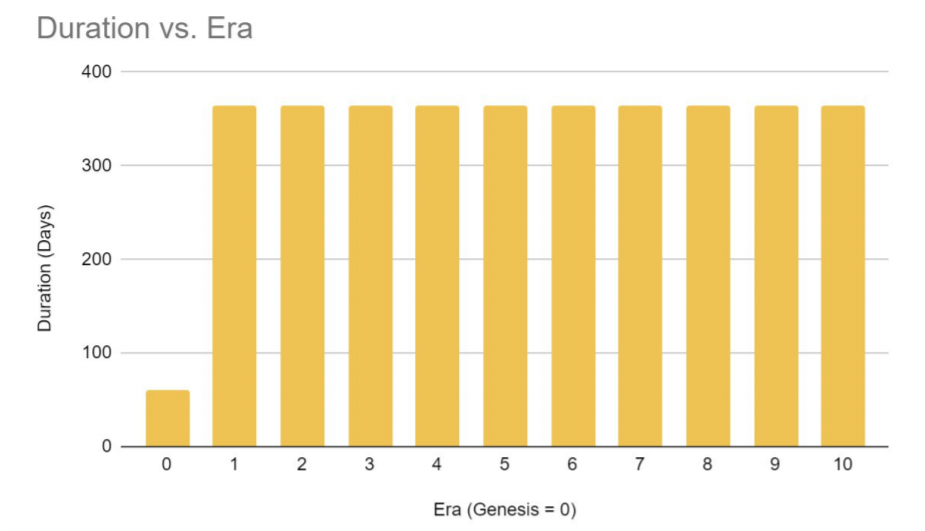

The FLOW token and its distribution would be governed by Eras. At the end of each Era, it is expected that the inflation rate would be halved, just like how the mining rewards in Bitcoin are always halved after a certain period.

The First Era of the would-be was called the Genesis Era, and it would last for a mere 60 days. Subsequent eras would last for 356 days, and there would only be ten of them.

During the Genesis Era, the daily inflation rate would start at 1%, and at the end, it would be halved.

Is FLOW Needed?

We all know that virtual assets like Bitcoin require their users to participate in either staking or mining of the token for them to receive part of the inflation supply. But these method poses several challenges that are highlighted below:

- Digital assets with consensus mechanisms tend to punish their holders as their values tend to become diluted, especially during inflation periods.

- The long-term value of these assets depends mainly on their ability to withhold inflation paid to miners and stakers in the protocol. This could prove to be a problem in the long term success of such protocols.

- Bitcoin, Ethereum, and the likes are tied to their underlying network, which leaves them open to fluctuation caused by network upgrades or even bugs in the system.

- Digital assets that require their holders to participate in actions like staking to receive their share of inflation leave such holders unprotected when they try to use them in other applications. It means that a holder looking to use his digital asset outside of that protocol would be left with a diluted version.

Understanding that these challenges can sometimes have a destabilizing effect on a protocol birthed the works of Flow. Flow protocol handles all essential distribution activities while allowing the Ethereum network to handle everything apart from that.

Flow Liquidity Mining

Flow provides an opportunity for anyone holding the token to become a liquidity provider on Uniswap through pooling their tokens with an equivalent USD of Ethereum.

When this pooling is successful, the holder and liquidity provider receives UNI-V2 tokens, representing their stake in the Uniswap liquidity pool. These newly-minted assets can then be staked to earn additional FLOW.

One important thing to note is that a would-be liquidity provider needs both the FLOW token and ETH.

How Rewards are Determined on the Pool

Several factors determine how much reward a staker earns for staking on the Pool. Some of them are:

The Amount staked

The amount of reward a user gets depends on the percentage of the total staked tokens that belong to that user. In other words, if 100% of the total staked tokens belong to one user, then that user gets all of the rewards.

The Number of Days a User Remain Staked

A user looking to enjoy the maximum earning power through this method must remain staked for a minimum of 60 days. This way, such users would enjoy a 3x multiplier reward. Other users would also enjoy the multiplier reward for as long as they stake too.

The Unlock Rate

Here, the total rewards are unlocked evenly after every 90 days.

Flow use cases

Below are some of the examples of the use cases of Flow that can be gotten via third-party platforms:

Liquidity Mining

Liquidity providers can use Flow to serve as a liquidity provider on different Decentralised exchange platforms.

Collateral

The token can diversify collaterals as it can be combined with digital assets that fulfill other roles like ETH or even AMPL.

Lending and Borrowing

Like most of the other dApps, Flow can also be used to lend and borrow on different decentralized platforms that support this feature.

Conclusion

Flow Protocol is a game-changer that looks to solve the challenges that come with inflation that affects the DeFi space.

Considerably, most dApps and crypto-asset look to reward their users who participate in either staking or mining of the token for them to be able to receive part of the inflation supply, but Flow solves this challenge as it spreads this inflation to all of its holders whether they participate in any transaction or not.

Furthermore, the protocol does not require any mining hardware, nor does it require any staking or the need to lock its token in a contract. Its even spread of inflation helps to create a fair store of value that can be used across various dApps.