There are many projects borne by decentralized finance (DeFi) innovation. But while most of them have been successful, a community backing the platform is still a lingering question for many. YF Link is a project that aims to build a new protocol that answers this exact concern.

Developing a platform that bridges two of the biggest DeFi protocols right now, Chainlink and Yearn.Finance is YF Link’s main purpose.

Table of Contents

Background

YF Link is a fork of Yearn.Finance (YFI). It was designed to handle LINK tokens as opposed to the yCRV tokens, a synthetic asset supported by YFI. The mission of the project is to create a community from loyal holders of Chainlink tokens called the “LINK Marines.” The platform was just launched on August 7, 2020.

There is still a lot of information anticipated by the public as to their plans for the platform and its future services. As of now, YF Link has already been making rounds in the DeFi space. LINK’s notable performance back in the early-2020 might have contributed to such interest.

A History with Yearn Finance

YF Link is not so different from its parent protocol, the Yearn Finance (YFI) platform. YFI was launched in July 2020 as a test in creating a liquidity pool and yield farming opportunity. The liquidity pools are facilitated by smart contracts that hold user deposits and redistribute them automatically on different pools for the best possible returns.

What is YF Link?

YF Link is a liquidity mining ecosystem that puts together the model behind Chainlink and Yearn Finance to provide a new yield farming product for crypto users. Through YF Link, users can access other liquidity pools such as Aave, Balancer, and Compound.

To participate in YF Link’s liquidity pool, users just have to deposit LINK tokens to smart contracts. This has led some observers to think that YF Link’s launch could have influenced the unexpected rise in LINK’s value recently.

Users who deposit funds to YF Link’s liquidity pool are given YFL rewards, the native token of the platform. The amount of reward that users receive is proportional to the amount that they have staked and how long their tokens have been held in smart contracts. Anyway, users have the option to take their deposits back whenever they wish to.

YF Link combines two popular DeFi concepts: yield farming and liquidity mining. Yield farming allows users to earn from their idle funds by distributing these assets in interest-generating pools that provide liquidity to partner exchanges and protocols.

Liquidity mining is another version for the same concept. This strategy allows users to stake in a liquidity pool to earn governance tokens as a reward. This secures community participation in the protocol and incentivizes user activity in keeping the platform healthy and operational.

Right now, the team is still working on adding new projects to their array of services, such as its token swap platform.

YFL Token

YF Links operates through its native token, the YFL. The cap for the supply of its native token is at 75,000 YFL.

YFL can be used to pay for smart contract fees, as a medium of exchange, staking, and governance. Since YF Link leaves to community voting almost all the important protocol decisions, YFL holders can also make proposals and vote on them.

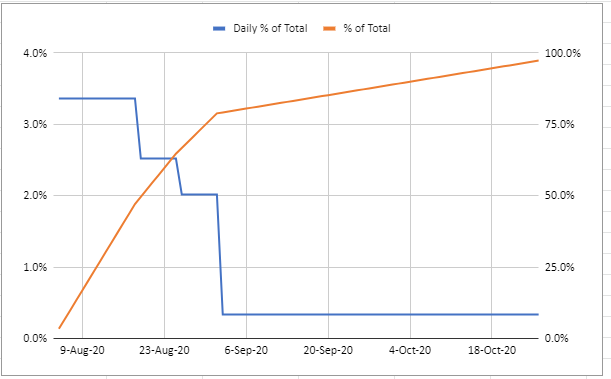

Currently, users can earn YFL tokens by providing liquidity in six pools governed by distinct parameters. The schedule for the release of YFL tokens from these pools will last until the fifteenth week of its operation, with its first four weeks allocated the most distribution share.

YFL Pools

The minting of YFL tokens is controlled for all the pools existing within the YFL ecosystem. The first few pools (0, 1, and 2) cannot mint new YFL tokens anymore. Staking in these pools cannot earn the users any YFL tokens anymore.

Pool 0 (Genesis Pool): This is the pool where users can stake LINK in the YFL pool. The pool was previously allocated 15,000 YFL rewards but it has already been emptied.

Pool 1 (LINK Balancer Pool): Users stake LINK and YFL to the Balancer pool. In return, stakers receive BPT tokens which are sent to the genesis pool. Rewards are YFL and BAL, but since this pool has been emptied of its YFL allocations (15,000 YFL), users cannot receive YFL from staking here.

Pool 2 (yCRV Balancer Pool): Users stake yCRV. The rewards are YFL, BAL, CRV tokens, and the interest accumulated from Curve. It was allocated 15,000 YFL rewards but these are emptied now.

Pool 3 (LINK Aave Pool): Users start staking by getting LINK and depositing them to Aave in exchange for aLINK tokens. aLINK tokens and YFL are then staked in the aLINK Balancer pool where they are given BPT which they can stake as well. Staking rewards are YFL, BAL, and the interest collected from Aave. The allocation is set at 15,000 YFL tokens.

Pool 4 (Governance Staking Pool): This is one of YF Link’s newly-launched pools. Users stake YFL to participate in the voting period for YF Link’s governance contract. Users receive YFL tokens as a reward too, with an allocation of 20,000 YFL tokens.

Pool 5: This pool was not intended for release, but since it is already out, it has been assigned for the mining of YFL creators. As of now, this is reserved for their responsibility to be the earliest miners for the platform but it can be used for other purposes too in the near future. The allocation is set at 5,000 YFL tokens.

LinkSwap

LinkSwap is an AMM (automated market maker) mechanism to be run by the YFL community. It is the forthcoming second product of YF Link designed to add safety and value capture opportunities for LINK holders. Here are its main features:

Impermanent Loss Reduction

AMMs automatically balance the ratio of assets in a liquidity pool. And with extreme price swings, you may end up with fewer assets than what you have started with. This is the opportunity cost of doing transactions on AMMs, which is referred to as “impermanent loss”.

And one of LinkSwap’s features is to reduce impermanent loss by implementing CLPs (continuous liquidity pools). Although liquidity mining yields via LINK will be less compared to traditional AMMs, at least liquid providers will suffer less impermanent loss on their tokens. This is especially attractive to LINK Marines, who value their LINK stack above yield rewards.

Scammer Protection

Scams are quite common in the DeFi space and usually come in the form of fake tokens traded against real assets or sudden removal of all liquidity by a listing pair creator, which is commonly called “rug pulling”.

LinkSwap overcomes this issue by producing some friction that would discourage scammers from listing new/fake token pairs. In addition, a gamification scheme will also be introduced in the process of supplying liquidity to a new pair’s pool.

Conclusion

DeFi space has provided the community with a lot of opportunities to earn profit from their idle assets. Options provided by such platforms made the conditions ripe for a vibrant community where users do not just deposit their assets and leave them there. With DeFi’s community governance functions, users can be rewarded by helping keep the platform healthy.

These sought after innovations in the DeFi space brought together a community that will back the DeFi space’s newcomer, YF Link. With a service ecosystem that allows for liquidity mining and yield farming, YF Link can be a formidable competitor with a growing community backing it. A lot of work still has to be done (including marketing) but this new protocol is already off to a good start.