Two of the leading developer teams of Texos (XTZ), Cryptonomic and SmartPy, are integrating Chainlink (LINK) oracles to the Tezos ecosystem.

The objective is to utilize Chainlink’s decentralized oracle network to provide real-time price feeds for Tezos projects.

This integration will enable Tezos project developers to pull live price feeds from numerous assets and build useful applications. One of which is the tokenized Bitcoin on the Tezos blockchain, tzBTC, a vehicle for the Tezos DeFi platform.

According to a Cryptonomic blog post, the addition of the Chainlink oracle service was made possible through a grant funded by the Tezos Foundation.

The smart contracts integration will be written using the SmartPy library while the Cryptonomic stack will be used for indexing, querying, and deployment.

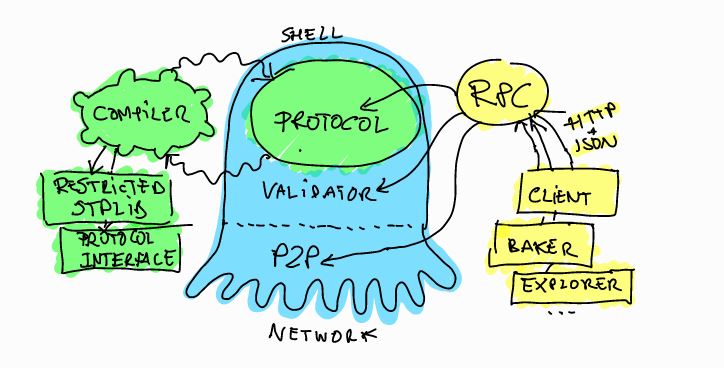

The Tezos Protocol

Tezos is a decentralized blockchain built for handling financial assets and applications. Last April 20, they announced the scheduled launch of their USD-pegged stablecoin, USDtz.

Yet running a stablecoin requires real-time pricing data feeds to work, which can only be taken from an external source. This is a conflict to Tezos’s purely on-chain governance setting.

Since the Tezos protocol relies on smart contracts to execute its applications, a decentralized oracle network like ChainLink’s is crucial if they want to expand their financial services.

This is positive step in the right direction, considering that several DeFi vulnerabilities have been exposed this year. Some of the recent DeFi hacks include dForce, bZx, and Uniswap.

Pulling data from sources like CoinMarketCap is risky. Decentralized oracles eliminate a DeFi platform’s single point of failure, in this case, having centralized data feeds.

Why Chainlink Oracles?

Chainlink has been securing partner after partner, and the demand for the Chainlink network is still escalating, especially their oracle service. According to Cryptonomic founder Vishakh,

We recommend Tezos developers use Chainlink when building smart contracts as Chainlink’s secure decentralized oracle network makes possible a plethora of new use cases across DeFi, Equities, Insurance, and much more.

The common question that arises is why won’t other blockchain projects just create their own decentralized oracle network. But the truth is many have tried.

Sergey Nazarov, the CEO of Chainlink, had told Coindesk that blockchain firms have found that building a decentralized pricing feed is a lot harder than it seems.

“Oracles are like a big onion … The more you dig into them the more layers of problems you discover. There’s a reason they don’t build it into a chain and there’s a reason they don’t encourage people to build their own. It’s because the depth of the problem initially isn’t obvious.”

As a result, blockchain companies that want to create strong layers of security have opted to outsource their oracle solutions with other protocols like Chainlink’s.