Does the mention of Sushi remind you of Japan? Well, now it should remind you of something else, decentralized finance (DeFi). Just as Sushi is popular in Japan, SushiSwap is popular in the DeFi world.

Part of its popularity comes from the fact that $250 million was locked in its smart contract within 24 hours of its release. This mirrors another DeFi protocol, YAM, which has gained a lot of hype but was later destroyed by errors in its smart contract and nearly faded from existence in a few days.

Although it’s an unaudited DeFi protocol, its spirited first days presented a boost to the DeFi community. However, before endorsing or criticizing it, let’s break it down from its origin up to its current glory. Furthermore, we’ll look for some missing links if there are any.

Table of Contents

Background

SushiSwap is spearheaded by an anonymous group or individual known by the moniker Chef Nomi. This is reminiscent of Bitcoin’s founding, which was also created by the mysterious Satoshi Nakamoto.

The project’s background can be understood through its parent, Uniswap. Uniswap is a blockchain-based protocol powering the exchange of Ethereum-based (ERC-20) tokens. The protocol emphasizes on security, censorship resistance, and efficiency in exchanging ERC-20 tokens.

What is SushiSwap?

SushiSwap is a hard fork of Uniswap, with added community-focused features while keeping its parent’s root design. Unfortunately, instead of curving its own path, the protocol is out to milk its parent’s liquidity.

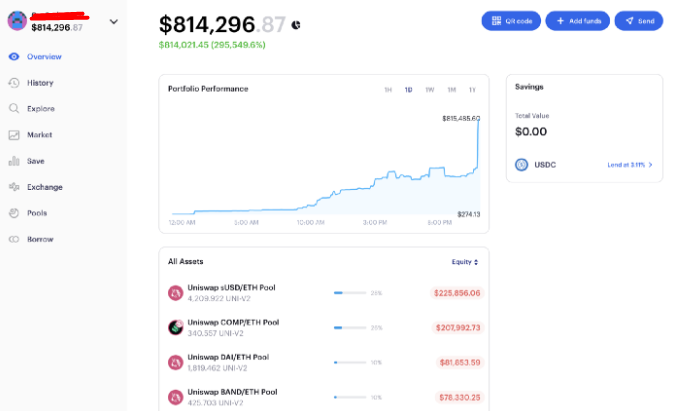

On the first day of existence, it fished $250 million from Uniswap. Three days later, it had milked roughly 80 percent of liquidity from its parent.

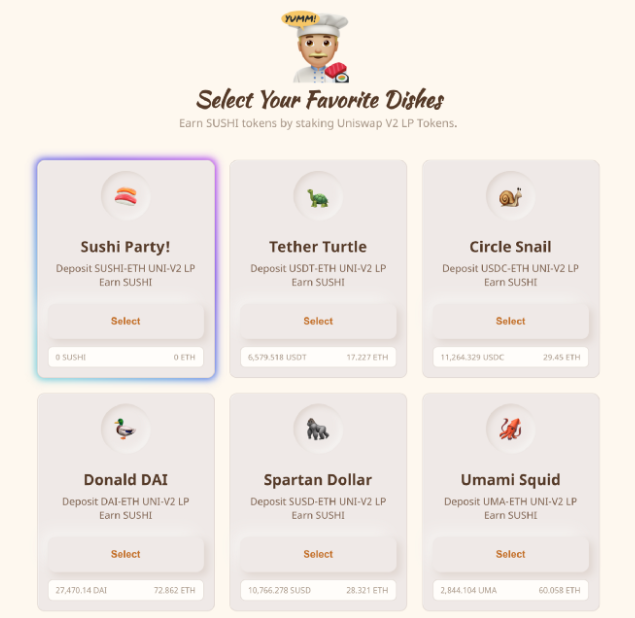

How the ecosystem works is divided into two phases; the first phase involves traders staking liquidity pool tokens from Uniswap and getting SUSHI in return. Next, traders shift the staked tokens and use them on the SushiSwap Decentralized Exchange (DEX).

Advantages of SushiSwap

More Incentives to Liquidity Providers

On Uniswap, liquidity providers earn from the trading fees generated on the network. Small liquidity providers are at risk of being eclipsed by huge cryptocurrency exchanges, mining pools, and other wealthy providers.

But, its spinoff looks to make it better by providing more incentives. Here, liquidity providers are rewarded in the form of SUSHI tokens. Providers earn a portion of the transaction fees generated by the system even when they stop providing liquidity.

An elaborate reward system

The original chain and the fork distribute the same percentage of trading fees but differ in their distribution mechanisms. On Uniswap, 0.3 percent is equally shared among a pool’s liquidity providers.

SushiSwap, on the other hand, proportionately distributes 0.25 percent of a pool’s trading fees to liquidity providers. The extra 0.05 percent is changed to SUSHI and spread to the token holders.

Support for security audit

Although the project is new, it seems to have figured out a ton of notable things. For instance, it offers recommendations to retain 10 percent of every token distribution to cater for security audits and continued development.

Is there a connection between SUSHI and YAM?

YAM Finance was one of the new DeFi protocols that got everyone excited about yield farming. The frenzy around the new way of making interest saw the decentralized protocol attract $600 million in assets within two days. The project was later shut down after a line of code in its contract revealed a gaping flaw.

Interestingly, just like YAM, SUSHI’s code is not audited. Security experts hold the opinion that DeFi protocols are shunning auditing to create an impression that the project is in demand. Although this has a similarity with SUSHI, experts believe that not all unaudited DeFi networks should be avoided.

The SushiSwap master chef portrays that all is well or slowly being baked to perfection. For example, the team behind the project has said that the audit of the smart contract will be completed before large scale deployment “to ensure there’s no bug in our code,” through a post on Medium.

Some security measures deployed to prevent malicious attacks include admin Function Timelock.

This is an innovative way to lock any admin-initiated activity to a wait time of 48 hours before execution. As such, if the admin decides to introduce a malicious ingredient to the SUSHI system, there will be enough time for stakers to “unstake” or withdraw their tokens.

Recent technical SushiSwap updates

User Interface (UI) update

The updated UI displays all the wrapped ETH staked and the total amount of tokens.

Introduction of ecosystem tools

The mysterious team behind the network has added tools to track the number of tokens staked in anticipation of SUSHI tokens.

Upcoming contract addition

The protocol has upcoming contracts subject to being audited by a reputable firm, including SushiMaker (tasked with collecting revenues and converting to SUSHI) and SushiBar (for staking SUSHI to earn more tokens). Additionally, there’s Migrator (for shifting Uniswap’s Master Chef liquidity provider tokens to SushiSwap), GovernorAlpha (for governance), and UniswapV2 (Modified version 2 Uniswap contracts to facilitate migration).

Security audit

To ensure transparency and boost confidence among users, the network has vowed to engage independent auditors. Although an in-house audit was done on the testnet, SushiSwap seeks to get external confirmation from Consensys, PeckShield, Certik, Trail of Bits, and OpenZeppelin, among others.

However, since it’s an open invitation, 5 ETH coins, from the protocol’s life-savings, will be used to pay the first firm to confirm the audit of SushiSwap. For transparency, everything on the network’s smart contract repository will be up for auditing.

Although the testnet is audited, MasterChef, the contract that handles yield farming, is unaudited. But, its simple nature makes it easy for ETH developers to sift through the code.

Conclusion

As the DeFi wave sweeps through the cryptocurrency field, many projects will rise, and others will fail. Unfortunately, when anything goes south, the DeFi community participating will carry the highest burden.

Although cryptocurrencies champion for anonymity, a project being run by an anonymous team or person does not fully gain the trust of its community. However, for SushiSwap, the outcome of an independent audit will improve or break the current energy around it.